Debt is core to real estate the same way fuel is to the airline industry, yet firms don’t manage debt as actively as airlines manage fuel.

Sure, everyone shops the quotes on the front end and some run refi scenarios throughout the year, but it’s really a secondary objective. Most firms treat it like a snapshot decision at the closing decision, and then when it comes time to sell or refi.

Why?

Because rates change every day, so the minute you run the analysis it’s already stale.

Because cashflows change every month, your analysis becomes stale very quickly.

Because chasing the next deal is more exciting.

Because it’s a pain!

Your team already has a ton on it’s plate. Now they need to go get the current balance, pull the docs to review the language around your prepayment penalties and calculate it, then get soft quotes from lenders…and then run the analysis.

And then the boss asks for a slight tweak to the analysis and everyone goes off and starts all over again. That’s just the snapshot today – is there an optimal time to refi in the next year? Or over the next 3 years? What if a tenant leaves unexpectedly?

Refi scenarios are even more important when new acquisitions are so competitive. If you spent a fraction of the time reviewing the existing portfolio, you could probably identify opportunities to improve debt and drive IRR.

Refi Breakeven

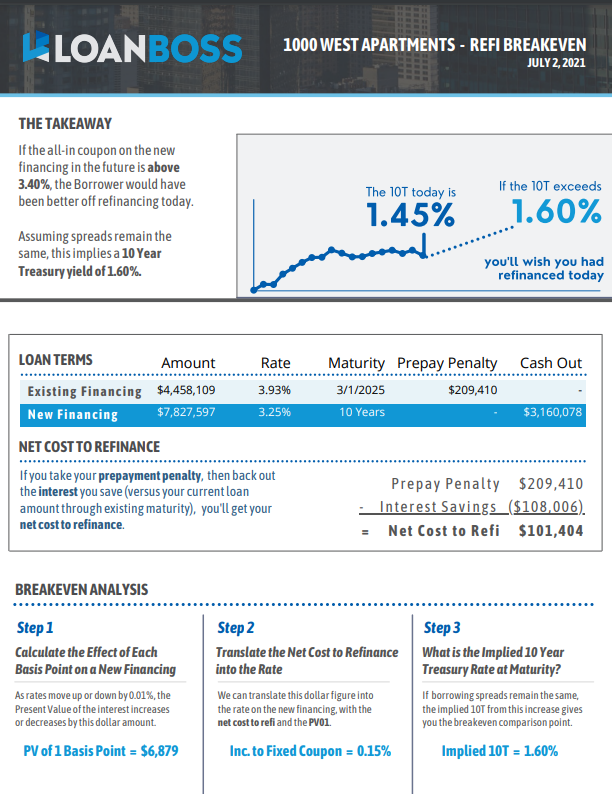

For example, how do you decide if it’s the right time to refi? After you get all of those numbers, we like to think about the following.

Sure, you’re paying a penalty and the new loan will have closing costs. But you’ll probably save money on the existing loan amount by lowering the rate between now and maturity.

Take that net penalty and translate it into an increase in rates between now and maturity.

That gives you your indifference point. If rates go up by more than that, you will wish you had paid the penalty to refi today.

Now imagine being able to do that for every deal, anytime, with the press of one button. All at the cost of less than 0.0001% to the effective rate of your portfolio.

Debt is the most expensive cost center you don’t think about largely because it’s so time consuming. But maybe you should.

Look into our debt management software here.

Talk to us at theboss@loanboss.com to identify the free money in your portfolio!